Today, we will discuss a fundamental topic in economics: the Theory of the Firm. This theory helps us understand how businesses operate, make decisions, and respond to environmental changes. We will explore the definition and types of firms, what constitutes an industry, the differences between firms and industries, and the various market structures. We will cover multiple aspects including costs, production, and profit, both in the short run and the long run.

Definition of a Firm

A firm is an organization that uses resources to produce goods or services for profit. Firms make decisions about production, pricing, and employment to maximize their profits.

Examples of Firms:

A local bakery is producing and selling bread and pastries.

A multinational corporation like Apple produces electronics and software.

Types of Firms

Firms can be categorized based on ownership, size, and the nature of their business. Here are the main types:

1. Sole Proprietorship

Definition: A business owned and operated by a single individual. The owner has full control and responsibility.

Advantages:

- Simple to establish and operate.

- Full control over decisions and profits.

Disadvantages:

- Unlimited liability for the owner.

- Limited ability to raise capital.

Example: A small retail store owned by one person.

2. Partnership

Definition: A business owned by two or more individuals who share profits, losses, and responsibilities.

Advantages:

- More capital is available than sole proprietorship.

- Shared responsibilities and expertise.

Disadvantages:

- Joint liability for debts.

- Potential for conflicts between partners.

Example: A law firm with multiple partners.

3. Corporation

Definition: A legal entity separate from its owners, providing limited liability to its shareholders.

Advantages:

- Limited liability for shareholders.

- Easier to raise capital through stock issuance.

Disadvantages:

- More complex and expensive to establish.

- Double taxation (corporate and shareholder levels).

Example: Toyota, an international automobile manufacturer.

4. Limited Liability Company (LLC)

Definition: A hybrid business structure that offers limited liability to its owners and flexible tax options.

Advantages:

- Limited liability for owners.

- Flexibility in management and taxation.

Disadvantages:

- Varies by jurisdiction, can be more complex than sole proprietorships or partnerships.

Example: Small tech startups often choose LLC structures.

Definition of Industry

An industry is a group of firms producing similar products or services and competing against each other.

Examples:

- The automotive industry includes companies like Ford, Toyota, and Honda.

- The tech industry includes firms like Google, Microsoft, and Samsung.

Difference between Firm and Industry

- Firm:

- An individual business entity.

- Focuses on internal operations and profit maximization.

- Industry:

- A collective of firms producing similar products or services.

- Focuses on market competition and overall market trends.

Market Structures

Market structures describe the competitive environment in which firms operate. The main types include:

1. Perfect Competition

Characteristics:

- Many small firms.

- Homogeneous products.

- Free entry and exit from the market.

- Perfect information.

Example: Agricultural markets, where many farmers sell identical products like wheat or corn.

2. Monopolistic Competition

Characteristics:

- Many firms.

- Differentiated products.

- Some barriers to entry.

- Firms have some control over prices.

Example: The restaurant industry, where each restaurant offers a unique dining experience.

3. Oligopoly

Characteristics:

- Few large firms dominate the market.

- Interdependent decision-making.

- Significant barriers to entry.

Example: The airline industry is dominated by a few major carriers.

4. Monopoly

Characteristics:

- A single firm controls the entire market.

- Unique product with no close substitutes.

- High barriers to entry.

- Price maker.

Example: Local utility companies, like electricity providers, often operate as monopolies.

Understanding Explicit Costs and Implicit Costs

In the study of economics, particularly when analyzing a firm’s costs and profitability, it’s crucial to differentiate between explicit and implicit costs. Let’s delve into these concepts, understand their significance, and explore real-world case studies to illustrate the differences.

1. Explicit Costs

Explicit costs are direct, out-of-pocket payments made by a firm to purchase inputs or resources. These costs are easily identifiable and recorded in the firm’s financial statements.

Examples of Explicit Costs:

- Wages paid to employees

- Rent for office or factory space

- Payments for raw materials

- Utility bills

- Marketing and advertising expenses

Characteristics:

- Direct payments

- Easily quantifiable

- Recorded in accounting books

2. Implicit Costs

Implicit costs represent the opportunity costs of utilizing resources that the firm already owns. These costs do not involve direct monetary payment and hence are not recorded in the firm’s financial statements.

Examples of Implicit Costs:

- Foregone salary if the owner works for the business without taking a salary

- Depreciation of company-owned equipment

- The potential rental income from property owned by the business but used for its operations

Characteristics:

- Indirect costs

- Not easily quantifiable

- Not recorded in accounting books

Difference between Explicit and Implicit Costs

| Aspects | Explicit Costs | Implicit Costs |

| Nature of Cost | Direct and out-of-pocket | Indirect and opportunity cost |

| Financial Statements | Recorded | Not recorded |

| Quantifiability | Easily quantifiable | Not easily quantifiable |

| Example | Salaries, rent, utilities | Foregone salary, depreciation, rental income |

World Around Us: Explicit Costs and Implicit Costs

Case Study 1: Small Business Owner (India)

Suppose a small business owner in Delhi runs a bookstore.

Explicit Costs:

- Monthly rent: ₹30,000

- Salaries to employees: ₹50,000

- Utilities and other expenses: ₹10,000

Implicit Costs:

- The owner foregoes a ₹60,000 monthly salary he could earn if employed elsewhere.

- The space used for the bookstore could be rented out for ₹25,000 per month.

Analysis: While the explicit costs of running the bookstore total ₹90,000, the implicit costs add another ₹85,000. The owner must consider both types of costs to understand the true economic cost of operating the business.

Case Study 2: Tech Startup (Pakistan)

A tech startup in Karachi, developing a new software application.

Explicit Costs:

- Office rent: PKR 100,000 per month

- Salaries for developers: PKR 500,000 per month

- Software licenses and utilities: PKR 50,000 per month

Implicit Costs:

- The co-founder, who is a skilled developer, could earn PKR 200,000 per month working for another tech firm.

- The initial investment of PKR 1,000,000 could earn interest if deposited in a bank.

Analysis:

In this case, explicit costs amount to PKR 650,000 monthly. The implicit costs include the forgone salary of PKR 200,000 and the potential interest income. These implicit costs significantly impact the true economic cost and profitability of the startup.

Case Study 3: Family Farm (Bangladesh)

A family runs a rice farm in rural Bangladesh.

Explicit Costs:

- Seeds and fertilizers: BDT 50,000

- Labor hired during harvest: BDT 20,000

- Equipment maintenance: BDT 10,000

Implicit Costs:

- The family could rent the land for BDT 30,000 annually.

- Family members work on the farm instead of earning wages elsewhere, potentially BDT 60,000 per year.

Analysis:

The explicit costs of the farm total BDT 80,000, but the implicit costs, including the forgone rental income and potential wages, add another BDT 90,000. The total economic cost gives a better picture of the farm’s financial health.

Hence understanding the difference between explicit and implicit costs is vital for making informed business decisions. Explicit costs are straightforward and recorded in financial statements, while implicit costs, though less visible, represent significant opportunity costs that affect overall profitability. By considering both, businesses can make more accurate assessments of their economic performance.

Relationship between Cost and Revenue

To understand the financial health and operational efficiency of a business, it is crucial to analyze the relationship between cost and revenue. This analysis helps businesses determine profitability, set prices, and make strategic decisions. Let’s explore this relationship in detail.

Cost: Cost refers to the total expenditure incurred by a firm in the production of goods or services. It includes various types such as fixed costs, variable costs, total costs, marginal costs, and average costs.

Revenue: Revenue is the total income generated from the sale of goods or services. It is calculated by multiplying the price per unit by the number of units sold.

Types of Costs

Fixed Costs: Costs that remain constant along with the level of output. Examples include rent, salaries, and insurance.

Variable Costs: Costs that vary directly with the level of output. Examples include raw materials and direct labor.

Total Costs: The sum of fixed and variable costs at any given level of output.

Marginal Cost: The additional cost incurred by producing one more unit of a good or service.

Average Cost: Total cost divided by the number of units produced.

Types of Revenue

Total Revenue: The total income received from the sale of goods or services. It is calculated as Price × Quantity.

Marginal Revenue: The additional revenue generated from selling one more unit of a good or service.

Average Revenue: Total revenue divided by the number of units sold.

Relationship between Cost and Revenue

World Around Us: Relationship between Cost and Revenue

Case Study 1: Apple Inc.

- Scenario: Apple’s introduction of the iPhone.

- Revenue: Apple’s total revenue from iPhone sales reached $137.8 billion in 2021.

- Cost: Production costs include research and development, materials, labor, and marketing.

- Analysis: Apple maximizes profit by pricing its iPhones to ensure that marginal revenue equals marginal cost. Despite high fixed costs in R&D, Apple’s substantial revenue leads to significant profits.

Case Study 2: Toyota Motor Corporation

- Scenario: Toyota’s production of hybrid vehicles.

- Revenue: Toyota’s revenue from hybrid vehicles exceeded $15 billion in 2020.

- Cost: Includes manufacturing, labor, and marketing costs.

- Analysis: Toyota achieves profit maximization by optimizing production costs and setting prices to ensure marginal revenue equals marginal cost. Economies of scale play a crucial role in reducing average costs.

Case Study 3: Tata Steel (India)

- Scenario: Production of steel products.

- Revenue: Tata Steel’s revenue for 2021 was approximately $19 billion.

- Cost: Includes raw materials, labor, and energy costs.

- Analysis: Tata Steel focuses on cost-efficient production methods to ensure that the marginal cost of producing an additional unit of steel is covered by the marginal revenue. The firm continually adjusts prices based on global steel demand to maximize profits.

Summary

Understanding the relationship between cost and revenue is essential for businesses to determine their profitability and make strategic decisions. By analyzing fixed, variable, total, marginal, and average costs alongside total, marginal, and average revenue, firms can identify the break-even point and the profit-maximizing level of output. Real-world examples from Apple, Toyota, and Tata Steel illustrate how companies effectively manage costs and revenues to achieve financial success.

This comprehensive understanding of cost and revenue dynamics will enable you to analyze business operations critically and make informed decisions.

Accounting Profit

Accounting profit refers to the difference between total revenue and explicit costs (these are expenses that can be easily identified and measured in monetary terms) incurred by a business or individual over a specific period of time.

Equation: Accounting Profit=Total Revenue−Explicit Costs

Total Revenue: This includes all income generated from selling goods or services.

Explicit Costs: These are the actual expenses incurred and include costs such as wages, rent, materials, utilities, etc.

Measurement: Accounting profit provides a straightforward measure of financial performance and is used extensively in financial statements and reports to assess the profitability of a business.

Economic Profit or Economic Surplus

- Implicit Costs: These are the opportunity costs that arise from using resources in a particular way rather than in their next best alternative use. They often include the cost of the owner’s time, the return that could be earned from the next best investment opportunity, and other non-monetary costs.

- Measurement: Economic profit provides a more comprehensive measure of profitability because it considers the true cost of resources used, including those that don’t involve direct monetary expenditures.

Key Differences:

- Scope: Accounting profit focuses solely on explicit costs and revenue, while economic profit considers both explicit and implicit costs.

- Purpose: Accounting profit is primarily used for financial reporting and tax purposes, whereas economic profit helps in making long-term business decisions by providing a more complete picture of profitability.

- Magnitude: Economic profit tends to be lower than accounting profit because it accounts for all costs, including opportunity costs, which are often overlooked in accounting profit calculations.

In summary, while both measures assess profitability, economic profit offers a broader perspective by incorporating opportunity costs, making it a more useful metric for decision-making in economics and business strategy.

Production Function

A production function is a fundamental concept in economics that describes the relationship between input factors and the output of goods or services. It is a mathematical representation that shows how different combinations of inputs produce varying levels of output.

Definition and Explanation

The production function can be expressed as: Q=f(L, K) where:

- Q is the quantity of output produced.

- L is the amount of labor used.

- K is the amount of capital used.

- f represents the production technology or process.

This function indicates the maximum output that can be produced with given amounts of labor and capital, assuming efficient use of resources.

Factors of Production

Production factors, also known as factors of production, are the inputs used in the creation of goods and services. They are the resources required to produce outputs. Understanding these factors is essential in analyzing how production processes work and how different inputs contribute to the overall production. The main factors of production are land, labor, capital, and entrepreneurship.

Land

Land encompasses all natural resources used in production. This includes physical land as well as minerals, forests, water, and other natural resources.

Characteristics:

· Finite Resource: The supply of land is limited.

· Passive Factor: Land itself does not produce anything until labor and capital are applied.

· Rent: The return on land is called rent.

In agriculture, land is crucial for growing crops. Countries with large arable lands like India and Bangladesh rely heavily on land for their agricultural output.

Labor

Labor refers to the human effort used in the production process. This includes physical and intellectual efforts.

Characteristics:

· Human Capital: Skills, education, and abilities of workers.

· Wage: The return on labor is wages.

· Variable Factor: Labor can be adjusted more easily than capital or land.

Example: In the tech industry, companies like Google depend on skilled labor, particularly software engineers, to develop and maintain their products.

Capital

Capital includes all man-made resources used in production. This covers machinery, buildings, tools, and equipment.

Characteristics:

Produced Means of Production: Capital goods are produced and used to produce other goods and services.

Depreciation: Capital assets can wear out or become obsolete over time.

Interest: The return on capital is called interest.

Example: Factories and machinery used in manufacturing plants, like those in China and Japan, are essential capital assets that drive production.

Entrepreneurship

Entrepreneurship involves the ability to bring the other factors of production together, make decisions, and bear risks in the pursuit of profit.

Characteristics:

· Risk-Taking: Entrepreneurs take risks in starting and running businesses.

· Innovation: They introduce new products, processes, and innovations.

· Profit: The return on entrepreneurship is profit.

Example: Entrepreneurs in Silicon Valley, such as those who founded companies like Apple and Tesla, combine various resources to create innovative products and services.

World Around Us Factors of Production

Case Study 1: Agricultural Production in Bangladesh

- Context: Rice farming is a major industry.

- Inputs: Land (fields), labor (farmers), capital (tractors, irrigation systems), entrepreneurship (farm management).

- Fact: In 2020, Bangladesh produced 37.1 million metric tons of rice, demonstrating the effective use of these production factors.

Case Study 2: Manufacturing in China

- Context: Electronics manufacturing.

- Inputs: Land (factories), labor (assembly line workers), capital (machinery, robots), entrepreneurship (management and innovation).

- Fact: China is the world’s largest electronics producer, with an export value of $753 billion in 2020.

Case Study 3: Tech Industry in Silicon Valley

- Context: Technology and software development.

- Inputs: Land (office space), labor (software engineers), capital (computers, servers), entrepreneurship (startup founders).

- Fact: Silicon Valley firms received $44.4 billion in venture capital investment in 2020, highlighting the region’s focus on innovative entrepreneurship.

Types of Production Functions

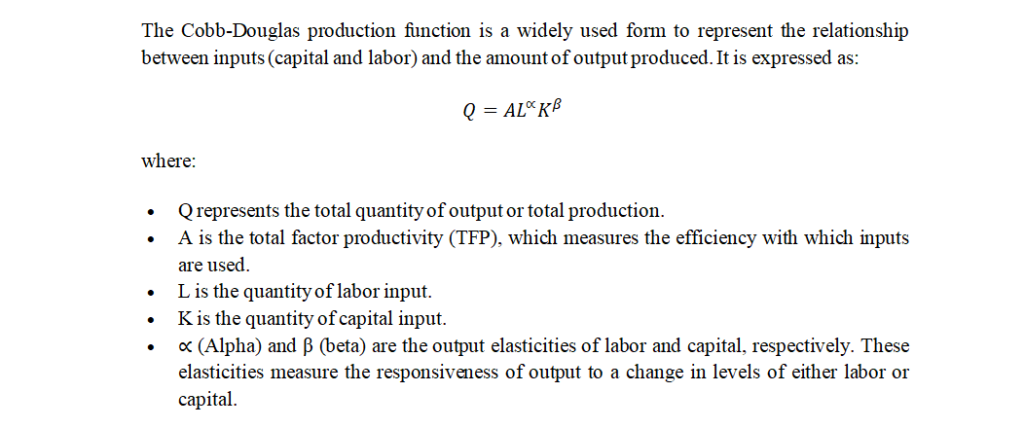

Cobb-Douglas Production Function

Total Factor Productivity (A)

- Total factor productivity (TFP) represents the efficiency with which inputs are transformed into outputs. It captures the effects of technological advancements, skill levels, and organizational improvements.

- High TFP indicates that an economy or firm is using its inputs efficiently.

- Improvements in TFP can result from technological innovation, better management practices, and higher skill levels among workers.

Example: In the technology sector, companies like Google have high TFP due to their advanced technologies and efficient use of resources. For instance, in 2020, Google’s TFP improvements were driven by innovations in artificial intelligence and machine learning.

Output Elasticities (α and β)

- α(alpha) is the elasticity of output with respect to labor. It indicates the percentage change in output resulting from a one percent change in labor, holding capital constant.

- β(beta) is the elasticity of output with respect to capital. It indicates the percentage change in output resulting from a one percent change in capital, holding labor constant.

Implications:

- If α+β=1, the production function exhibits constant returns to scale. This means that doubling both labor and capital will double the output.

- If α+β>1, there are increasing returns to scale, implying that doubling inputs more than doubles the output.

- If α+β<1, there are decreasing returns to scale, meaning that doubling inputs results in less than double the output.

Example: In the manufacturing sector, a factory might experience increasing returns to scale when it expands its production facilities and workforce, leading to more than double the output due to efficiencies gained from larger operations.

World Around Us: Cobb-Douglas Production Function

Case Study 1: Agricultural Sector in India

- Context: Indian agriculture often uses a combination of traditional labor-intensive methods and modern capital-intensive techniques.

- Details: In 2018, India’s agricultural output increased by 5% due to a 3% increase in labor (farmers) and a 4% increase in capital (tractors, irrigation systems).

- Implications: The output elasticity of labor (α) and capital (β) can be conditional from the proportionate increases in output relative to inputs, reflecting the Cobb-Douglas function’s application.

Case Study 2: Industrial Production in China

- Context: China is known for its vast industrial sector with significant investments in both labor and capital.

- Details: Between 2015 and 2020, China’s industrial output grew by 40%, with labor increasing by 10% and capital by 20%.

- Implications: This case demonstrates the impact of α and β in a scenario of increasing returns to scale, where significant capital investment drives substantial output growth.

Case Study 3: Technology Sector in South Korea

- Context: South Korea’s tech industry, including giants like Samsung, relies heavily on advanced capital and skilled labor.

- Details: In 2019, Samsung’s output increased by 15% with a 5% increase in labor and a 10% increase in capital.

- Implications: The relatively high elasticity of capital (β) reflects the industry’s reliance on cutting-edge technology and equipment to boost productivity.

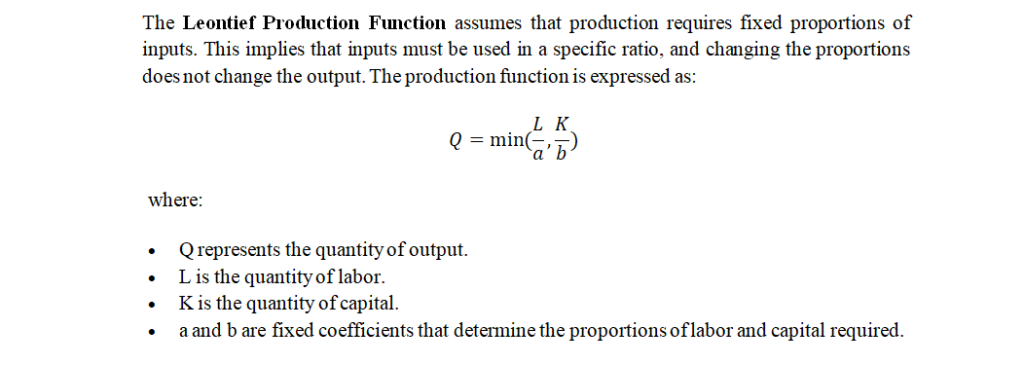

Leontief Production Function

Characteristics:

- Fixed Input Ratios: Inputs must be combined in fixed ratios. For example, if a=2 and b = 3, then every unit of output Q requires 2 units of labor and 3 units of capital.

- No Substitutability: Inputs cannot be substituted for one another. If the required ratio is not met, additional inputs do not increase output.

- Complementary Inputs: Inputs are perfect complements, meaning both are required in specific amounts to produce output.

Example: Manufacturing Automobiles:

In a car factory, suppose 2 workers and 1 machine are required to produce one car. If there are 4 workers and only 1 machine, only 2 cars can be produced, even though there are enough workers to potentially produce 4 cars.

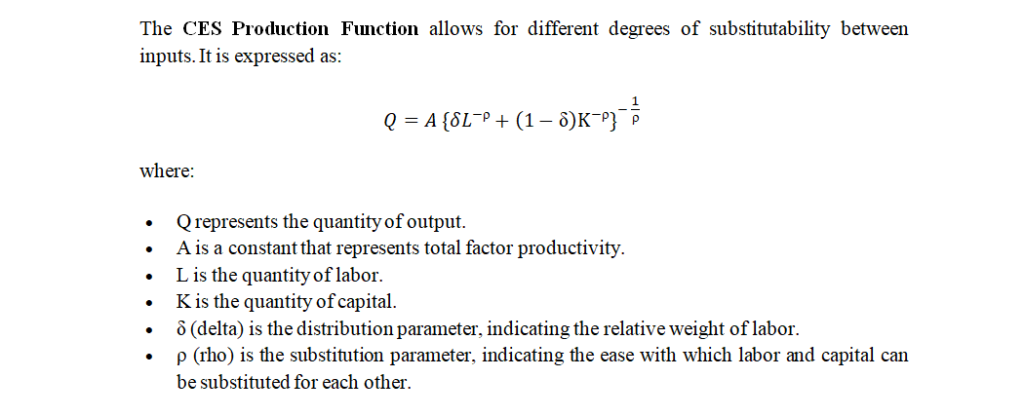

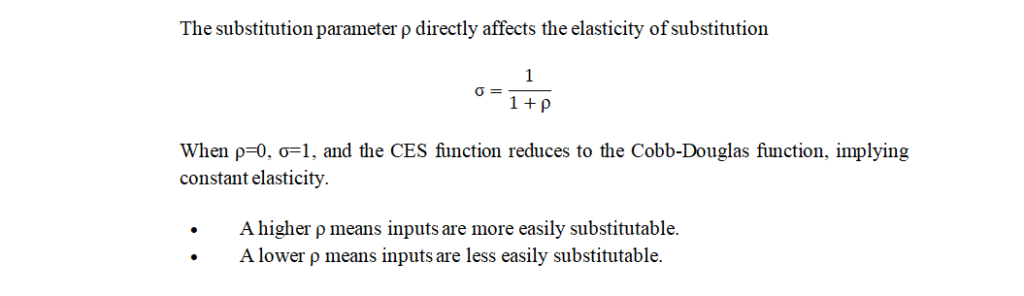

CES (Constant Elasticity of Substitution) Production Function

Characteristics:

- Variable Substitutability: Inputs can be substituted for one another to varying degrees, depending on the value of ρ.

- Elasticity of Substitution: The parameter ρ determines the elasticity of substitution (σ=sigma), which measures the responsiveness of the ratio of inputs used to changes in their marginal rate of technical substitution.

- If ρ=0 CES function becomes a Cobb-Douglas function with a constant elasticity of substitution equal to 1.

- If ρ→∞, inputs are perfect substitutes.

- If ρ→−∞ ( -infinity), inputs are perfect complements.

Example: Energy Production:

In an energy plant, coal and natural gas can be used as inputs. Depending on their prices and availability, the plant can adjust the proportions of coal and natural gas used. The CES function allows for modeling this flexibility in input substitution.

· Total Factor Productivity (A)

Total factor productivity (TFP) in the context of the CES function indicates the efficiency with which labor and capital are used. A higher A implies a more efficient production process.

· Distribution Parameter (δ)

The parameter δ determines the relative importance of labor in the production process. If δ is closer to 1, labor has a higher impact on output relative to capital. Conversely, if δ is closer to 0, capital has a higher impact.

· Substitution Parameter (ρ)

Comparison of Leontief and CES Production Functions

Here look at the comparison of the Leontief and CES (Constant Elasticity of Substitution) production functions based on substitutability, flexibility, and application:

| Aspect | Leontief Production Function | CES Production Function |

| Substitutability | No substitutability; fixed input ratios. | Variable substitutability; flexibility in input ratios depending on ρ. |

| Flexibility | Rigid; inputs must be in fixed proportions. | Flexible; allows varying degrees of substitution. |

| Application | Suitable for industries with rigid production processes, like some manufacturing sectors. | Suitable for industries with more flexible production processes, like energy production or technology sectors. |

World Around Us: Production Functions

Case Study 1: Textile Industry in Bangladesh (Leontief)

- Context: The textile industry in Bangladesh requires fixed ratios of labor and machinery.

- Details: In 2015, a factory needed 5 workers and 2 sewing machines to produce 100 garments. Even with 10 workers, only 100 garments could be produced with 2 machines.

- Implications: This demonstrates the Leontief production function, where inputs are used in fixed proportions.

Case Study 2: Renewable Energy Sector in Germany (CES)

- Context: Germany’s renewable energy sector can switch between wind and solar energy depending on availability and cost.

- Details: In 2020, due to high solar panel prices, Germany increased its reliance on wind energy. The CES function models this flexibility.

- Implications: The CES function allows an understanding of how Germany adjusts input use based on relative costs and technological advances.

Case Study 3: Agriculture in India (CES)

- Context: Indian farmers use a mix of labor and machinery for cultivation.

- Details: In 2019, due to a labor shortage, farmers increased the use of tractors and automated equipment. The CES function captures this substitutability.

- Implications: The CES function helps analyze how Indian agriculture adapts to labor and capital changes, ensuring efficient production.

By understanding both the Leontief and CES production functions, we can better analyze different production processes, their efficiencies, and how they adapt to changing economic conditions. These functions provide valuable insights into the mechanics of production and the interplay between various inputs in generating output.

Difference between fixed and variable inputs (Factors of Production)

In economics, understanding the distinction between fixed and variable inputs is crucial for analyzing production processes and making informed business decisions. Let’s delve into these concepts in detail.

Definition of Fixed Inputs

Fixed inputs are production factors that remain constant regardless of the level of output produced. These inputs do not change in the short run, meaning they are not easily adjustable within a specific period. Fixed inputs are typically associated with costs that are incurred even if the production level is zero.

Characteristics of Fixed Inputs:

- Inflexibility: Fixed inputs cannot be altered quickly or easily in response to changes in production levels.

- Long-term commitments: Investments in fixed inputs often involve long-term commitments.

- Examples: Capital equipment, buildings, land, machinery, and salaried personnel.

World Around Us: Fixed Inputs

Case Study 1: Manufacturing Industry

In the automobile manufacturing industry, assembly line machinery and factory buildings are considered fixed inputs. Regardless of the number of cars produced, these inputs remain constant. For instance, Toyota’s investment in its manufacturing plants remains fixed whether it produces 100 cars or 1,000 cars in a month.

Case Study 2: Agriculture Sector

A farmer’s purchase of land for cultivation is a fixed input. The size of the land does not change with the amount of crop produced. For example, a rice farmer in India with a 50-acre plot incurs fixed costs related to the land, irrespective of the yield in a given season.

Case Study 3: Retail Business

In the retail sector, a store’s lease is a fixed input. Whether the store sells one item or hundreds, the rent remains constant. For instance, a supermarket chain like Walmart has fixed rental costs for its store locations, regardless of sales volume.

Definition of Variable Inputs

Variable inputs are production factors that can be adjusted in the short run in response to changes in the level of output. These inputs fluctuate based on production needs and are directly tied to the quantity of goods or services produced.

Characteristics of Variable Inputs:

- Flexibility: Variable inputs can be easily adjusted to meet production demands.

- Short-term adjustments: These inputs are often managed on a day-to-day or month-to-month basis.

- Examples: Raw materials, direct labor, utilities, and shipping costs.

World Around Us: Variable Cost

Case Study 1: Textile Industry

In the textile industry, raw materials like cotton and synthetic fibers are variable inputs. The quantity purchased varies with the level of garment production. For example, a textile mill in Bangladesh adjusts its purchase of fabric based on seasonal demand for clothing.

Case Study 2: Food Services

In a restaurant, ingredients and hourly wages for staff are variable inputs. If a restaurant anticipates a busy weekend, it orders more food supplies and schedules additional staff. A fast-food chain like McDonald’s adjusts its inventory and staffing levels based on projected customer foot traffic.

Case Study 3: Electronics Manufacturing

In the electronics manufacturing industry, components like semiconductors and circuit boards are variable inputs. A company like Samsung adjusts its orders for these parts based on the production schedule for smartphones and other devices.

Key Differences between Fixed and Variable Inputs

| Aspect | Fixed Inputs | Variable Inputs |

| Definition | Inputs that remain constant regardless of output. | Inputs that vary with the level of output. |

| Adjustment | Cannot be easily changed in the short run. | Can be easily adjusted in the short run. |

| Examples | Buildings, machinery, salaried employees. | Raw materials, hourly labor, utilities. |

| Cost Nature | Incur fixed costs. | Incur variable costs. |

| Time Frame | Long-term commitments. | Short-term adjustments. |

| Flexibility | Inflexible. | Flexible. |

Impact on Business Decisions

Understanding the distinction between fixed and variable inputs helps businesses make strategic decisions regarding:

- Cost Management: Identifying fixed and variable costs aids in budgeting and financial planning.

- Scalability: Recognizing which inputs can be scaled up or down allows for more efficient production planning.

- Profit Maximization: By managing variable inputs effectively, firms can optimize production and enhance profitability.

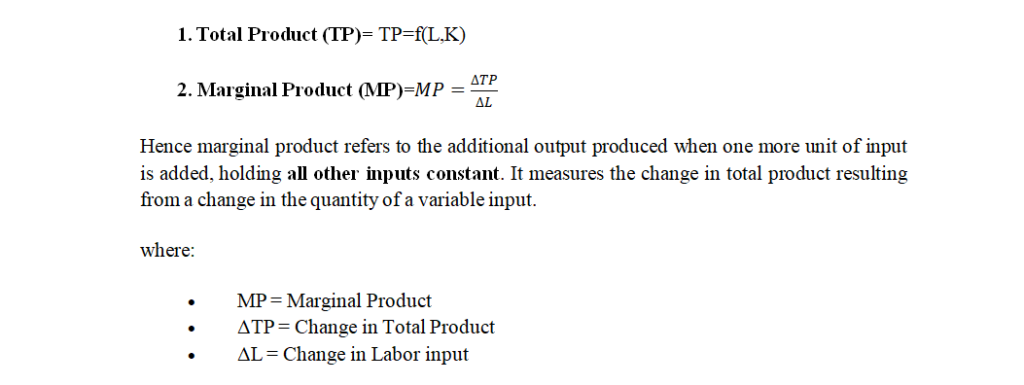

Difference between Total and Marginal Product

The concepts of total product and marginal product are crucial in analyzing production processes and making decisions in the field of economics. We know from the discussion above that

Example: If adding one more worker to a factory increases the total output from 100 units to 120 units, the marginal product of labor is: MP=120−100=20 units.

Relationship between Total and Marginal Product

Phases:

- Increasing Returns to Scale: When additional units of a variable input lead to a higher increase in total product, the marginal product rises.

- Diminishing Returns to Scale: When additional units of a variable input lead to a smaller increase in total product, the marginal product decreases.

- Negative Returns to Scale: When additional units of a variable input reduce the total product, the marginal product becomes negative.

Mathematical Relationship:

- When MP is positive and increasing, TP increases at an increasing rate.

- When MP is positive but decreasing, TP increases at a decreasing rate.

- When MP is zero, TP is at its maximum.

- When MP is negative, TP decreases.

Example: Service Industry

In the service industry, such as a call center in India, the total product could be the total number of calls handled. Initially, adding more customer service representatives increases the total number of calls handled significantly. However, after a certain number of representatives, the additional calls handled by each new representative (marginal product) decrease because of limited phone lines or workstations. For instance, increasing the staff from 100 to 120 might increase handled calls from 10,000 to 12,500, but increasing staff further to 140 might only increase handled calls to 13,000.

Law of Diminishing Marginal Product vs the Law of Diminishing Returns

The Law of Diminishing Marginal Product and the Law of Diminishing Returns are closely related concepts in economics, often used interchangeably. However, there are subtle differences between them.

1. Law of Diminishing Marginal Product

The Law of Diminishing Marginal Product states that as additional units of a variable input (e.g., labor) are added to a fixed input (e.g., capital), the additional output (marginal product) produced by each additional unit of the variable input will eventually decrease, holding all other factors constant.

Key Points:

- This law applies in the short run, where at least one factor of production is fixed.

- It highlights the point at which the efficiency of the variable input starts to decline.

Example: Consider a factory with a fixed number of machines (capital). Initially, adding more workers (labor) increases total output significantly. However, after reaching an optimal number of workers, adding more workers leads to overcrowding and inefficiencies, causing the additional output per worker to decrease.

2. Law of Diminishing Returns

The Law of Diminishing Returns states that as additional units of a variable input are added to fixed inputs, the overall increase in output will eventually become smaller, and beyond a certain point, total output may even decrease.

Key Points:

- This law encompasses the diminishing marginal product but also considers the total production.

- It applies in the short run and considers the overall impact on total production, not just marginal output.

Example: In agriculture, if a farmer keeps adding more fertilizer to a fixed plot of land, the crop yield (total output) initially increases at an increasing rate. Eventually, the additional crop yield from each unit of fertilizer decreases, and if too much fertilizer is added, it may even harm the crops, reducing total yield.

Comparison

| Aspect | Law of Diminishing Marginal Product | Law of Diminishing Returns |

| Focus | Additional output from one more unit of input | Total output increases at a decreasing rate, and may decrease |

| Context | Short run (one fixed input) | Short run (one or more fixed inputs) |

| Impact on Output | Marginal output decreases | Total output increases at a decreasing rate and may decrease |

| Example | Additional workers in a factory | Additional fertilizer on a fixed plot of land |

World Around Us: Laws of Diminishing Marginal Product

Case Study 1: Manufacturing Industry

- Scenario: A smartphone manufacturing plant with fixed machinery.

- Observation: Initially, adding more workers significantly boosts production. However, after a certain point, additional workers lead to overcrowding, reducing the marginal product per worker.

- Data: Adding 10 workers increased output from 1000 to 1500 units. Adding another 10 only increased it to 1700 units.

Case Study 2: Agriculture

- Scenario: Rice farming with a fixed amount of land.

- Observation: Applying more fertilizer initially increases yield, but excessive use leads to reduced effectiveness and potential crop damage.

- Data: Initial fertilizer application increased yield by 20%. Beyond a certain level, additional fertilizer only increased yield by 5%, and further application led to a 10% decrease in yield.

Case Study 3: Service Sector (India)

- Scenario: Call center operations with a fixed number of phone lines.

- Observation: Adding more customer service representatives initially improves call handling capacity, but too many representatives lead to inefficiencies and reduced marginal productivity.

- Data: Increasing staff from 50 to 60 improved call handling from 5000 to 6000 calls. Increasing to 70 staff only increased it to 6500 calls, and adding more caused call handling issues.

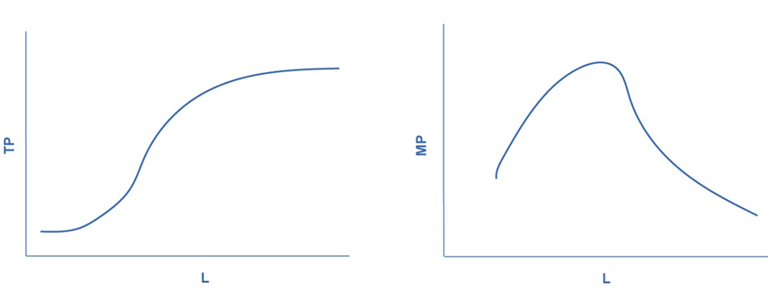

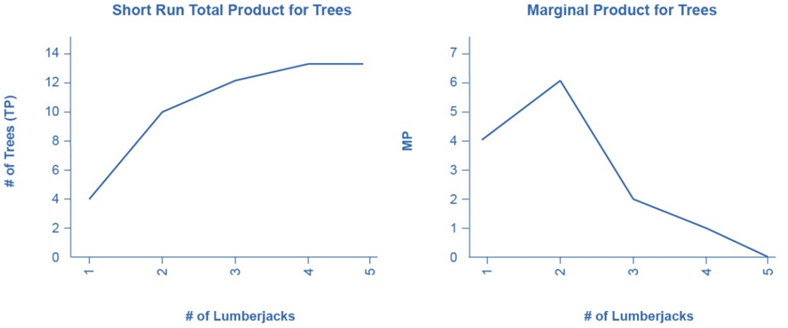

Graphical Representation of TP and MP

Consider a logging company where the output is the number of trees cut down per day, and the inputs are the number of lumberjacks working. Here’s a numerical representation:

| Lumberjacks (L) | Trees (Total Product, TP) | Marginal Product (MP) |

| 1 | 4 | 4 |

| 2 | 10 | 6 |

| 3 | 12 | 2 |

| 4 | 13 | 1 |

| 5 | 13 | 0 |

Total Product (TP): The total quantity of output produced with a given amount of labor. For example, 1 lumberjack produces 4 trees, 2 lumberjacks produce 10 trees, and so on.

Marginal Product (MP): The additional output produced by employing one more unit of labor. It is calculated as MP=ΔTP/ΔL. For instance,

Total Product Curve (Figure 8.2a): This graph plots the total product (trees) on the y-axis against the number of lumberjacks on the x-axis. The curve initially rises steeply, indicating increasing output with additional workers, but eventually levels off, showing that additional workers add less to the total output.

Marginal Product Curve (Figure 8.2b): This graph plots the marginal product on the y-axis against the number of lumberjacks on the x-axis. The curve initially rises, reaches a peak, and then declines, eventually reaching zero.

Theory of the Firm through the Lens of Behavioral Economics

Traditional economic theory assumes that firms are profit-maximizing entities that make rational decisions based on cost, production, and market competition. However, behavioral economics introduces the idea that firms, like individuals, may be influenced by cognitive biases, emotions, and social pressures that lead them to deviate from purely rational decision-making.

Scenario: Decision-Making in Small Firms

Consider a small manufacturing firm that faces increasing competition from larger companies. According to traditional economics, the firm would respond by adjusting its prices, improving efficiency, or investing in innovation to stay competitive. However, behavioral economics reveals that small firms may react differently due to biases and other psychological factors.

Behavioral Economics Insights

Loss Aversion and Sunk Costs:

Loss Aversion: The firm may fear losses more than they value equivalent gains. This can result in the firm continuing to invest in unprofitable products or markets to avoid the psychological pain of admitting failure.

Sunk Cost Fallacy: The firm may hold onto a failing product line because of the resources already invested, even though rational decision-making would suggest cutting losses and redirecting resources to more profitable areas.

Fact and Figure: A study of small and medium-sized enterprises (SMEs) in the UK found that 60% of firms continued investing in failing projects due to sunk costs, even when evidence showed that redirecting investment would improve profitability.

Overconfidence Bias:

Overconfidence: Small business owners might overestimate their ability to succeed in highly competitive markets, leading them to make risky investments or expand too quickly without adequate preparation.

Fact and Figure: Research from the Harvard Business Review showed that 75% of small business owners were overly optimistic about their firm’s prospects, resulting in overexpansion and financial difficulties for 40% of these firms within five years.

Herd Behavior and Conformity:

Herd Behavior: Firms may follow industry trends or the strategies of competitors without properly evaluating if those strategies suit their specific circumstances. This can lead to inefficiencies and missed opportunities for differentiation.

Fact and Figure: A survey of start-ups in the tech industry revealed that 50% of firms implemented strategies similar to their competitors, even though only 20% saw measurable success from these decisions.

Anchoring in Pricing:

Anchoring: Firms may set prices based on historical pricing models or competitor pricing, even if market conditions have changed. This can lead to suboptimal pricing strategies that fail to maximize profits.

Fact and Figure: An analysis by McKinsey found that 35% of firms in the retail sector anchored their prices to competitors, resulting in lost revenue opportunities of up to 15% due to failure to optimize pricing for their own cost structure.

Impact and Analysis

Behavioral economics explains that firms, especially smaller ones, are not always rational in their decision-making. Cognitive biases like loss aversion, overconfidence, and anchoring influence their choices, leading to inefficiencies and missed profit opportunities. For instance, a small firm may continue investing in an outdated product line due to loss aversion and sunk costs, even when better alternatives exist.

The case study shows that behavioral biases are critical factors in understanding why firms may struggle to adapt to competitive pressures or market changes. These biases can prevent rational decision-making, leading to persistent inefficiencies.

Summary

While traditional economic models focus on profit maximization, behavioral economics highlights that firms often make decisions influenced by biases, emotions, and social dynamics. Addressing these biases through training, better decision-making frameworks, and external advice could help firms make more rational and profitable choices.

References

- Tversky, A., & Kahneman, D. (1979). Prospect Theory: An Analysis of Decision under Risk.

- Harvard Business Review (2016). The Overconfidence Bias in Small Business Decision-Making.

- McKinsey & Company (2017). Pricing Strategies in Competitive Markets: A Behavioral Economics Approach.

Research Suggestions for Economists

- Behavioral Impact on Firm Pricing Strategies: Investigate how cognitive biases like anchoring and overconfidence impact pricing decisions and the effectiveness of behavioral interventions to improve firm performance.

- Decision-Making Under Risk and Uncertainty: Explore how firms make investment decisions under uncertainty, considering the impact of biases like loss aversion and the sunk cost fallacy.

- Behavioral Nudges for Small Business Efficiency: Study the effectiveness of behavioral nudges in helping small and medium-sized enterprises optimize their decision-making processes, particularly in the areas of resource allocation and pricing.

- Cognitive Biases and Business Failure Rates: Analyze the role of cognitive biases in business failure rates, focusing on overexpansion, poor risk assessment, and conformity to industry trends.

These research avenues can deepen the understanding of firm behavior and provide valuable insights into how behavioral economics can improve business decision-making.

Important Abbreviations

Here’s a breakdown of the differences between the corporate endings mentioned in the lecture:

- Inc. (Incorporated): This indicates that the company is a corporation, a separate legal entity from its owners. This provides liability protection to the owners, meaning their personal assets are generally not at risk for the company’s debts.

- Co. (Company): This is a more general term that can be used by various types of businesses, including corporations, partnerships, and sole proprietorships. It doesn’t necessarily indicate a specific legal structure.

- Corp. (Corporation): This is another abbreviation for “corporation,” similar to “Inc.” It signifies that the company is a separate legal entity with limited liability for its owners.

- Ltd. (Limited): This is commonly used in countries that follow the British legal system. It indicates that the company’s liability is limited to the amount of capital invested in the business.

Key Points:

- Inc., Corp., and Ltd. typically signify a corporation with limited liability for its owners.

- Co. is a more general term and doesn’t necessarily indicate a specific legal structure.

- The choice of ending a company or industry name often depends on the specific legal requirements and preferences of the company and its jurisdiction.

Critical Thinking

- How do the different characteristics of the factors of production (land, labor, capital, and entrepreneurship) impact the overall efficiency and productivity of a firm?

- Consider how the finite nature of land, the variability of labor, the depreciation of capital, and the risk-taking nature of entrepreneurship each influence production decisions.

- Why might a firm choose to invest more in one factor of production over another? Provide examples of industries where this might occur.

- For instance, why might a tech company prioritize skilled labor and capital over land? Conversely, why might an agricultural business prioritize land?

- How do factor payments influence the cost structures of different types of businesses?

- Analyze how the fixed nature of rent and the variable nature of wages impact business models in industries like retail vs. tech.

- Discuss how the law of diminishing marginal productivity might affect a company’s decision to hire additional workers.

- Use a real-world example to illustrate how increasing labor might initially boost production but eventually lead to reduced marginal returns.

- How do the concepts of fixed and variable costs relate to the factors of production and factor payments?

- Explore how different businesses manage fixed costs (like rent) and variable costs (like wages) to remain profitable.

- In what ways do interest rates and dividend payments affect a company’s capital structure and investment decisions?

- Discuss how fluctuating interest rates can impact a firm’s decision to take on new loans or issue dividends to shareholders.

- How does the risk-taking nature of entrepreneurship drive innovation and economic growth?

- Provide examples of how entrepreneurial activities have led to significant economic advancements or new industries.

- What role does human capital play in the competitiveness of a firm, and how can a firm enhance its human capital?

- Consider strategies such as training, education, and employee benefits.

- How do changes in the availability of natural resources (land) impact industries reliant on these resources?

- Discuss scenarios like droughts affecting agriculture or mineral shortages impacting manufacturing.

- How might government policies influence the distribution and utilization of factors of production?

- Analyze the impact of tax incentives, subsidies, and regulations on business decisions regarding land, labor, capital, and entrepreneurship.

- Agricultural businesses like farming heavily rely on land, whereas technology companies rely more on skilled labor and capital investments in technology and equipment.

- Manufacturing firms invest heavily in capital, such as machinery and equipment, and must balance these with the labor required to operate them efficiently.

- Service-oriented businesses, like consulting firms, primarily invest in skilled labor, with capital investments being less significant.

- Startups often face high initial risks and require a combination of capital investment and innovative labor to succeed, with profits being the primary motivator for risk-taking.

- A factory employs 50 workers, each earning a wage of $20 per hour. Each worker works 8 hours a day, 5 days a week. Calculate the total weekly wage cost for the factory.

- An entrepreneur starts a business with total revenues of $200,000 and total costs of $150,000. Calculate the profit.

- A company takes a loan of $100,000 at an annual interest rate of 5%. Calculate the annual interest payment the company needs to make.

- A company purchases machinery worth $50,000. The machinery has an expected life span of 10 years with no salvage value. Calculate the annual depreciation expense using the straight-line method.

- Using the provided table, calculate the Marginal Product (MP) for each additional lumberjack.

| Lumberjacks | Total Product (Trees) | Marginal Product (MP) |

| 1 | 4 | 4 |

| 2 | 10 | 6 |

| 3 | 12 | 2 |

| 4 | 13 | 1 |

| 5 | 13 | 0 |

- A company has fixed costs of $30,000 per year and variable costs of $50 per unit produced. If the company produces 1,000 units in a year, calculate the total cost.

31. A factory has the following costs for different levels of output, calculate the average cost per unit for each level of output and discuss whether the firm is experiencing economies of scale.

| Output (units) | Total Cost ($) |

| 100 | 10,000 |

| 200 | 18,000 |

| 300 | 24,000 |

One Comment