The International Monetary Fund (IMF) is a global organization with 189 member countries, headquartered in Washington D.C., that provides financial assistance to its member countries to support their economic stability and development. Pakistan has had a history of seeking financial assistance from the International Monetary Fund (IMF) to address its balance of payment issues. In exchange for IMF loans, the country typically agrees to implement economic reforms aimed at correcting imbalances in its economy and improving its overall financial stability. Over the years, Pakistan has received multiple IMF loans to address various economic challenges.

It’s worth noting that IMF loans come with conditions attached, and implementing these conditions can be a difficult and politically sensitive process for the recipient country. Nevertheless, IMF assistance has been instrumental in helping many countries, including Pakistan, address their financial difficulties and promote economic growth.

Over the years, Pakistan continued to face economic challenges and sought several loans from the IMF to meet its growing needs. Here is a list of the IMF loans to Pakistan:

- March 16, 1965: US$ 37,500

- October 17, 1968: US$ 75,000

- $35 million in 1970

- May 18, 1972: US$ 84,000

- August 11, 1973: US$ 75,000

- November 11, 1974: US$ 75,000

- US$47,500 on February 12, 1975

- US$ 70,000 on June 6, 1975.

- US$200,000 on December 1, 1976

- March 9, 1977: Standby Arrangement of US$ 80,000

- November 24, 1980: Extended Fund Facility of US$ 349,000

- December 2, 1981: US$ 730,000

- December 28, 1988: US$ 194,480

- December 28, 1988: Structural Adjustment Facility Commitment of US$ 382,410

- September 16, 1993: Standby Arrangement of US$ 88,000

- February 22, 1994: US$ 123,200

- February 22, 1994: US$ 172,200

- December 13, 1995: US$ 294,690

- October 20, 1997: US$ 265,370

- October 20, 1997: US$ 113,740

- November 29, 2000: US$ 465,000

- December 6, 2001: US$ 861,420

- November 24, 2008: US$ 4,936,035

- September 4, 2013: Extended Fund Facility of US$ 4,320,000

It is important to note that this is not a comprehensive list and there may have been other loans from the IMF to Pakistan that are not included here.

The loss of East Pakistan and the subsequent Bangladesh Liberation War had a significant impact on Pakistan’s economy and its financial situation. To address its growing needs, the country turned to the IMF for financial assistance. We have mentioned that Pakistan received several loans from the IMF in the 1970s and 1980s, including the ones in 1972, 1973, 1974, 1977, and 1980. These loans helped the country address its balance of payment difficulties and stabilize its economy. The loan amount was originally given in Special Drawing Rights (SDRs), which is an international reserve asset created by the International Monetary Fund (IMF) when Pakistan borrowed from IMF for the first time in 1958. SDRs are used to supplement the existing monetary reserves of member countries, and they can be exchanged for freely usable currencies. In this case, the loan amount was equivalent to US$25 million when it was disbursed. However, borrowing from the IMF came with conditions, and the country was required to implement economic reforms and austerity measures to receive the loans. Furthermore, Pakistan’s involvement in the US-led Cold War against the Soviet Union added to the country’s financial burden, leading to the need for additional loans from the IMF. Despite these challenges, Pakistan continued to receive financial support from the IMF over the years to help address its balance of payment difficulties and restore stability to its economy. In November 1980, This Extended Fund Facility loan of $349,000 from the IMF was aimed at supporting Pakistan’s economic program and helping the country overcome its balance of payment difficulties. The loan was disbursed over 3 years and was subject to regular reviews and performance assessments by the IMF to ensure that the country was following through with its economic reforms and meeting its performance targets. It’s also worth noting that the 1980s was a period of increased global economic instability, with many countries facing balance of payment difficulties and seeking assistance from the IMF. In the case of Pakistan, the country was also heavily involved in the Cold War as a US ally, which added to its economic burden and contributed to the need for further financial assistance from the IMF.

The return of democracy to Pakistan in 1988 marked a new era in the country’s history, but unfortunately, the same economic challenges and problems continued. The government of Prime Minister Benazir Bhutto took out two loans from the IMF, one in the form of a standby arrangement and another in the form of a structural adjustment facility commitment, to address the balance of payment difficulties.

However, the government of Prime Minister Nawaz Sharif, which came to power in 1990, decided against seeking further assistance from the IMF and instead sought donations from friendly countries, such as Saudi Arabia, to address its economic challenges. This was a departure from the previous practice of seeking financial assistance from the IMF and reflected a shift in the government’s approach to addressing economic issues.

Prime Minister Benazir Bhutto returned to power in 1993 and her government reached an agreement with the IMF for a standby arrangement of US$88 million. However, due to poor handling of the economy by her government, Pakistan had to seek further assistance from the IMF, including a loan under the extended fund facility and another loan of US$172.2 million. This marked the third time in the period of Bhutto’s government that Pakistan had to seek assistance from the IMF. It’s worth noting that there were allegations of corruption during Bhutto’s government, and according to some sources, it was considered to be one of the most corrupt governments in the history of Pakistan.

Nevertheless, despite these challenges, the country continued to seek financial assistance from the IMF to address its balance of payment difficulties and support economic growth. Prime Minister Nawaz Sharif came to power in 1997 after the previous government of Benazir Bhutto was sacked on corruption charges. The economy of Pakistan was in a difficult state, and the Sharif government went to the IMF on an urgent basis to seek financial assistance. An agreement was reached with the IMF to receive two loans, one for US$265.37 million and another for US$113.74 million, on October 20, 1997. These loans were intended to support Pakistan’s efforts to address its balance of payment difficulties and promote economic growth.

In 1999, General Pervez Musharraf took over as the head of state in Pakistan after toppling the government of Nawaz Sharif. Despite the interruption of democratic rule, the country continued to seek financial assistance from the IMF. During his nine-year rule, General Musharraf secured two loans from the IMF, amounting to SDR 1.33 billion, though at relatively low-interest rates. This shows the importance placed on IMF loans in addressing the economic difficulties faced by the country, regardless of the political situation.

In 2008, Prime Minister Yousaf Raza Gillani‘s government received a loan of US$7.6 billion from the IMF. This loan was part of an economic assistance package aimed at helping Pakistan address its balance of payment difficulties and support economic growth. The loan was provided under the IMF’s Stand-By Arrangement program, which provides financing to member countries facing balance of payment difficulties to help address their economic challenges and promote economic stability.

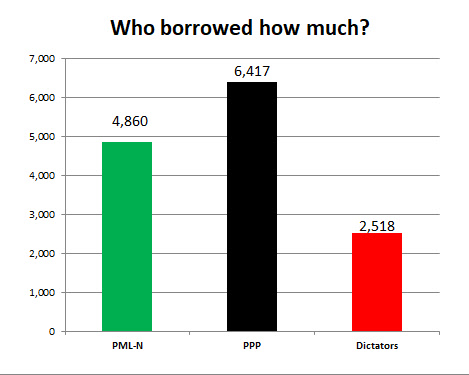

The stats here clearly depict that Pakistan has borrowed around SDR 13.79 billion from the IMF, out of which 47% of the loans were secured by PPP, followed by PML-N at 35%, while the military dictatorships lag behind with a mere 18%. The PPP has secured IMF loans 10 times during their different tenures in government.

In 2018, Imran Khan became the Prime Minister of Pakistan and his government initially sought financial assistance from friendly countries like Saudi Arabia, United Arab Emirates, and China to avoid the tough conditions associated with borrowing from the IMF. As of 2018, Pakistan has received IMF loans 21 times over the last 60 years, and there was a need for around $28 billion for the current fiscal year to meet its financial needs. However, it is important to note that the actual loan amount, terms, and conditions of each loan varied depending on the economic situation of Pakistan and the IMF’s assessment of the country’s ability to repay the loans. The IMF provides loans to member countries with balance of payment difficulties to support their economic reforms and promote sustainable growth. However, in 2019, as the economic conditions in Pakistan worsened, the government decided to approach the IMF for a loan of US$1 billion. The IMF approved the loan on the condition that Pakistan implements a series of economic reforms, including a hike in energy tariffs, the removal of energy subsidies, an increase in taxation, the privatization of public entities, and fiscal policies aimed at reducing the budget deficit. These conditions were aimed at promoting economic stability and addressing the balance of payment difficulties faced by the country.

In recent years, Pakistan has been working with the IMF on a new program aimed at restoring stability to the economy and putting the country on a path to sustainable growth. PDM regime is seeking another bailout package from IMF. The press release of IMF indicates that the IMF mission held from January 31 – February 9, 2023, in Islamabad has been productive. Here is a list of key points that can be concluded in this press release based on the statement by Mr Nathan Porter of the IMF:

- Introduction: A brief overview of the purpose of the IMF mission and the main message being conveyed.

- Background information: Information about the IMF mission and the ninth review of the authorities’ program supported by the IMF Extended Fund Facility (EFF) arrangement.

- Key announcements: A clear and concise summary of the main announcements made by Mr Porter, including the IMF team’s welcome of the Prime Minister’s commitment to implement policies and the progress made during the mission on policy measures.

- Priorities: A list of the key priorities discussed during the mission, including strengthening the fiscal position, reducing subsidies, scaling up social protection, allowing the exchange rate to be market-determined, and enhancing energy provision.

- Quotes: A statement from Mr Porter, emphasizing the importance of the timely and decisive implementation of these policies for Pakistan to regain macroeconomic stability and advance its sustainable development.

- Next steps: Information about virtual discussions that will continue to finalize the implementation details of the policies.

- His statement highlights the importance of the implementation of policies for Pakistan to achieve macroeconomic stability and sustainable development. The phrase “timely and decisive implementation” suggests that the authorities must take prompt and firm action in implementing the policies discussed during the IMF mission. The reference to “resolute financial support from official partners” highlights the need for additional support from other countries or organizations to fully achieve the desired outcomes. Overall, this statement emphasizes the need for a collaborative effort between the authorities, the IMF, and other partners to ensure that the necessary policies are effectively implemented to achieve macroeconomic stability and sustainable development in Pakistan.

It’s worth noting that not all of the IMF loans extended to Pakistan have been fully disbursed. Some agreements have been cancelled before the loan amount was fully disbursed, while others have had their disbursements suspended due to the country’s failure to meet certain economic performance targets.

This program includes a series of economic reforms and measures aimed at improving the country’s fiscal position and boosting its economic growth. It’s important to keep in mind that borrowing from the IMF can help alleviate short-term financial difficulties, but it also comes with conditions that can be difficult to implement and have long-term consequences for the economy. Additionally, borrowing from the IMF repeatedly can signal a lack of progress in addressing the underlying structural issues in the economy and may affect investor confidence. It’s important to note that the implementation of the IMF program alone won’t be a magic solution for Pakistan’s economic challenges, and the government and relevant stakeholders will need to take proactive measures to ensure that the loan is used effectively and sustainably. This includes implementing structural reforms to increase the country’s competitiveness, promoting growth, and addressing inefficiencies in the economy. The Pakistani government must implement reforms and make efforts to diversify its economy, to ensure sustained growth and stability in the long run.

*The article was last updated on Feb 10, 2023.