Combat global recession with lower interest rates. Understand the impact of global recessions and how countries can effectively combat them through lower interest rates. Learn how the 2020 pandemic prompted the successful implementation of this strategy. Explore the role of interest rates in economic stability and combating inflation. Discover the potential benefits of lowering interest rates.

Introduction

In times of economic instability, the world faces the challenge of a global recession. This article provides an understanding of what a global recession entails and how countries can combat it effectively by implementing lower interest rates. By examining the impact of the pandemic in 2020, we will explore how different countries successfully employed this strategy to improve economic stability and lower inflation rates.

Understanding Global Recession

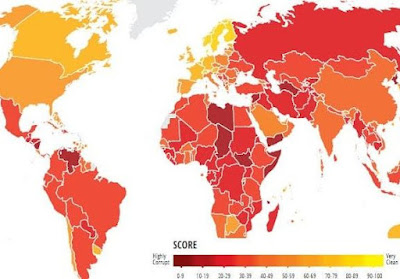

A global recession is a period of significant economic decline that simultaneously affects multiple countries. It is characterized by a widespread decrease in economic activities, such as reduced production, decreased consumer spending, and rising unemployment rates. Global recessions have far-reaching consequences on both developed and developing nations, impacting trade, investments, and financial markets worldwide.

The Role of Interest Rates in Combating Recession

Interest rates play a crucial role in managing and mitigating the effects of a recession. Central banks, as custodians of monetary policy, can influence interest rates to stimulate or cool down economic growth. By lowering interest rates, central banks encourage borrowing and investment, thereby boosting consumer spending and business activities. This strategy aims to inject liquidity into the economy, promoting economic recovery and revitalization.

Lowering Interest Rates during the 2020 Pandemic

During the unprecedented times of the 2020 pandemic, many countries faced the challenge of a looming recession. To counteract the negative impact of the pandemic on their economies, governments and central banks implemented measures to lower interest rates. By reducing interest rates to near-zero or single-digit percentages, these countries sought to incentivize borrowing, investment, and spending, providing a much-needed boost to their economies.

Steven B. Kamin found that the increase in sovereign debt among emerging market economies (EMEs) during the pandemic presented significant challenges for some countries, particularly Brazil and South Africa. However, the decrease in global interest rates alleviated the burden for many other emerging market governments. As a result, a widespread crisis affecting multiple emerging markets appeared less probable in the upcoming year. EMEs should seize the opportunity presented by low rates to refinance a substantial portion of their debt and even consider borrowing additional funds to build a reserve for potentially more challenging times. It is essential to recognize that although the current low rates and ready availability of funding may justify the increase in EME debt, the situation can swiftly change, turning the higher debt levels into a significant source of risk. By improving the debt repayment mechanism, this risk can be minimized.

The Federal Reserve Bank (US) made a decisive and urgent move to strengthen the economy amidst the COVID-19 pandemic. It stated its intention to cut the target interest rate to nearly zero. This bold action by the Federal Reserve was aimed at providing substantial support and stability to the economy during those challenging times.

Economic Stability and Lower Inflation

1. Lowering interest rates during the pandemic helped countries achieve economic stability and combat inflationary pressures.

2. When interest rates are low, businesses and individuals find it more affordable to borrow money. This increased borrowing stimulates investment in various sectors, leading to economic growth.

3. Lower interest rates can help reduce the burden of debt repayments for businesses and individuals, allowing them to allocate resources more efficiently and spur economic activity.

4. Moreover, by lowering interest rates, countries can combat inflation. Inflation refers to the increase in the general price level of goods and services over time. By stimulating economic growth through lower interest rates, countries can prevent deflationary pressures and maintain a healthy level of inflation. This balanced inflation rate ensures stability in the economy and promotes confidence among businesses and consumers.

Conclusion

In conclusion, a global recession poses significant challenges for countries around the world. However, by implementing appropriate measures, such as lowering interest rates, governments and central banks can effectively combat recessionary pressures. The case of the 2020 pandemic highlighted the success of this strategy in improving economic stability and reducing inflation rates. By creating an environment conducive to borrowing, investment, and spending, countries can stimulate economic growth and navigate the challenges posed by a global recession. Some researchers argue for the potential drawbacks of lowering interest rates. We will discuss this issue separately.

FAQs

Q: How does a global recession impact the average person?

- A global recession can lead to rising unemployment rates, reduced job security, and decreased consumer spending, which may affect individuals\’ financial stability.

Q: Are lower interest rates beneficial for businesses?

- Lower interest rates can be advantageous for businesses as they encourage borrowing and investment, promoting economic growth and expansion opportunities.

Q: Can lowering interest rates lead to excessive borrowing and a subsequent financial crisis?

- While lower interest rates incentivize borrowing, effective regulations and oversight by central banks can help prevent excessive borrowing and mitigate the risk of a financial crisis.

Q: Are there any drawbacks to lowering interest rates?

- Lowering interest rates can potentially lead to increased inflationary pressures and reduced returns on savings and investments, which may impact certain individuals and sectors negatively.

Q: How long does it take for lower interest rates to stimulate economic growth?

- The time frame for interest rate changes to impact the economy varies and depends on various factors, such as the overall economic conditions and the responsiveness of businesses and consumers to the policy changes.

3 Comments