The proposal of “Applied Islamic Economics” is innovative and aligns well with ongoing discussions in Islamic economics. It combines theoretical foundations with empirical analysis. By incorporating real-world case studies and modeling interest-free scenarios, this framework can provide a robust argument for the feasibility of a welfare state under Islamic principles.

Feasibility of Constructing an Islamic Economic System

- Principles: Islamic economics emphasizes welfare for all, ethical considerations, and the prohibition of interest (riba). It promotes risk-sharing, equitable distribution, and the integration of moral values in economic transactions.

- Case Studies: Analyzing real-world scenarios under an interest-based economy is straightforward due to abundant data. For an interest-free economy, while fewer examples exist, simulations and assumptions (e.g., dummy variables) can be used to model outcomes.

Brief Introduction to Applied Islamic Economics

We propose analyzing two scenarios:

- Interest-Based Economy:

- Factors such as interest rates, employment, inflation, and others impact GDP.

- Reflects a conventional economic model with tangible and intangible variables.

- Interest-Free Economy:

- Assumes zakat replaces interest as a redistributive tool.

- Focuses on welfare for all, emphasizing ethical growth, equitable distribution, and introducing moral values.

Key Considerations for Feasibility

- Modeling Real GDP:

- Interest-Based Formula: Real GDP=f (Interest Rate, Employment Rate, Inflation, Literacy Rate, Real Assets Growth, Social Welfare, Crime Ratio, Moral Values, State Tax Rate)

- Interest-Free Formula: Real GDP= f (Zakat, Employment Rate, Inflation, Literacy Rate, Islamic Taxes, Real Assets Growth, Welfare for All)

- Case Studies and Data:

- Interest-based economies have significant data availability.

- Interest-free economies like Pakistan’s zakat system or Islamic banking models in Malaysia can provide valuable insights.

- Hypothetical Models with Dummy Variables:

- When real-world examples are absent, use a dummy variable (e.g., setting interest rate = 0) to simulate interest-free scenarios.

- COVID-19 Pandemic Case Studies:

- Analyze how different regions implemented welfare measures during the pandemic.

- Assess whether the principles of Islamic economics (e.g., charity, solidarity) were informally adopted.

- Ethical and Moral Dimensions:

- Measure “moral values” and “social welfare” through proxies like crime rates, trust indices, and equitable access to resources.

Challenges

- Data Collection: Limited data on large-scale Islamic economies.

- Quantifying Moral Variables: Factors like “moral values” and “welfare for all” are subjective and hard to quantify.

- Acceptance of Assumptions: Using dummy variables or hypothetical constructs may face academic scrutiny.

Interest-Free Economy Through E-Views

Introducing a dummy variable to simulate an interest-free economy in E-Views can provide meaningful insights, even if real-world case studies are unavailable. Here’s how you can incorporate the zero dummy variable, interpret its effects, and analyze the outcomes:

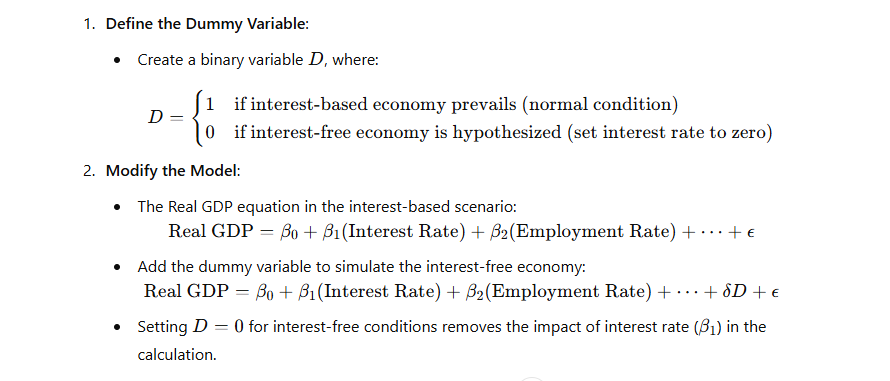

Incorporating a Dummy Variable for an Interest-Free Economy

A dummy variable represents a binary condition (e.g., interest-based = 1, interest-free = 0). Here’s how to use it in EViews:

Steps in EViews

- Incorporate Data:

- Include historical data for Real GDP, interest rate, employment, and other variables.

- Add the dummy variable column (D) to your dataset.

- Set Interest Rate to Zero:

- For the interest-free scenario, replace interest rate values with zero where D=0.

- Run Regression:

- Use the modified Real GDP equation with the dummy variable:

ls RealGDP c InterestRate EmploymentRate Inflation LiteracyRate Dummy

- Use the modified Real GDP equation with the dummy variable:

- Compare Results:

- Estimate the model for both scenarios (D=1 and D=0).

- Analyze how the coefficients and significance levels change.

Interpretation

- Coefficient of Dummy Variable (δ):

- Measures the difference in Real GDP under the interest-free economy.

- A significant negative δ(delta) suggests the economy might struggle without interest. A significant positive δ indicates the interest-free model could boost GDP.

- Impact on Interest Rate (β1):

- Setting the interest rate to zero allows us to study the economy without interest.

- If β1 is small or insignificant in the interest-based scenario, the transition to interest-free might have minimal economic disruption.

- Alternative Variables:

- Analyze if other variables (e.g., zakat, Islamic taxes) gain more explanatory power in the absence of interest.

- Scenario Comparison:

- Use in-sample forecasts or simulations to compare GDP growth under both scenarios.

- Evaluate the contribution of moral and welfare variables.

Challenges in Interpretation

- Abrupt Change:

- In reality, setting the interest rate to zero abruptly (as in Pakistan) could disrupt financial markets.

- Dummy-based analysis assumes no sudden shock or adaptation cost.

- Assumption of Perfect Substitution:

- Assumes zakat or Islamic taxes will seamlessly replace interest-based mechanisms. Real-world implementation may differ.

- Policy Implications:

- Results must consider broader systemic effects, such as liquidity constraints and investor confidence.

Concluding Insights

Using a dummy variable to simulate an interest-free economy in E-Views is a valid approach to test hypotheses. However, the interpretation must account for practical challenges and policy nuances. This analysis can reveal whether an interest-free economy could sustain or enhance growth and welfare under Islamic principles.